There are very strict rules surrounding the provision of advice under corporations law. We are unable to provide advice without first understanding your situation. General advice is not personal advice. It is general information that is provided without an understanding of your personal situation.

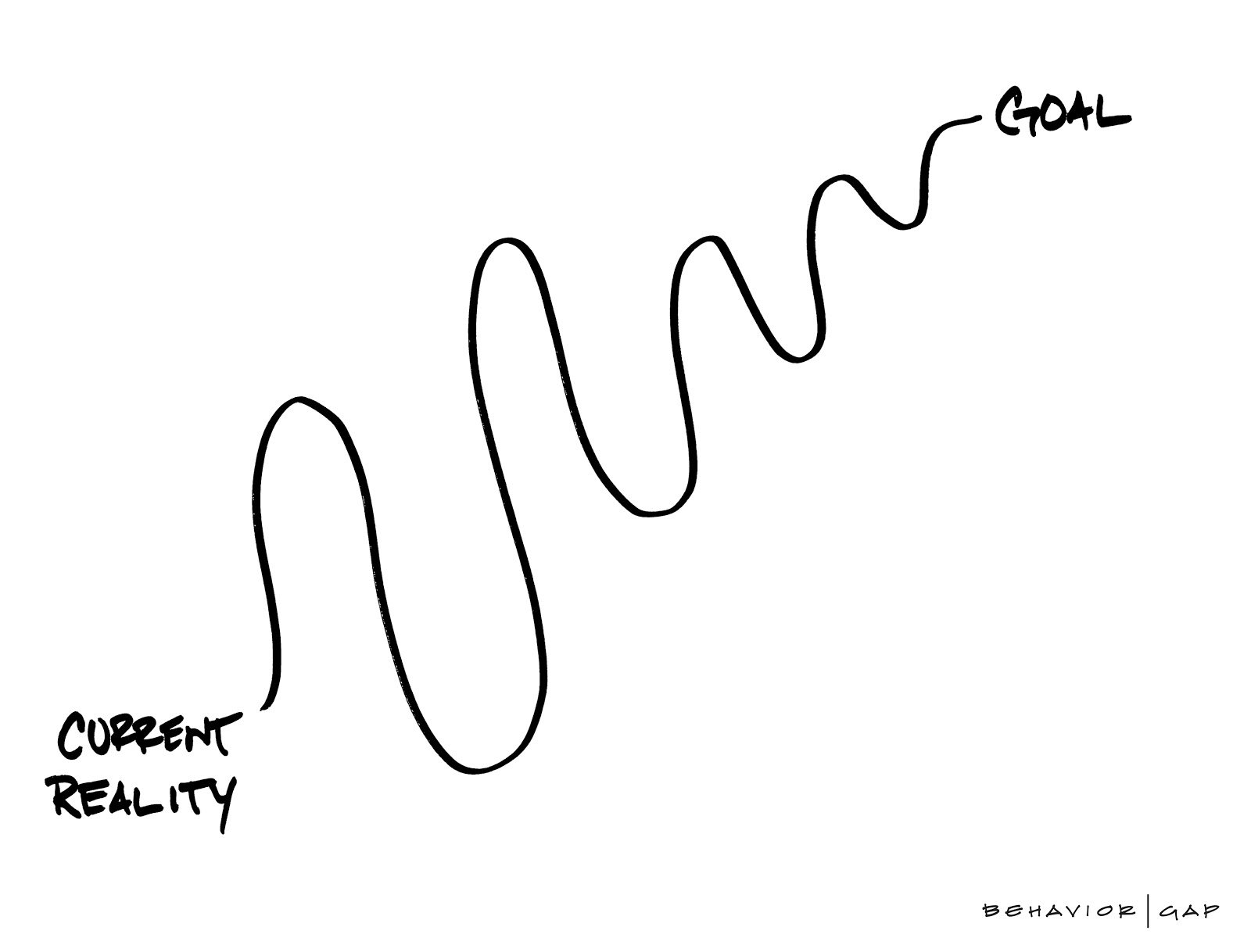

Personal, tailored advice requires an understanding of your goals. But most people are not in a position to immediately express what these are. At WWA, we believe in the process of advice more than the plan itself. Plans tend to draw straight lines, but life is all curves:

When considering engaging with a financial planner, you should perform the following steps:

1. Look up their name on the Financial Advisers Register

The register tells you:

- the adviser’s qualifications, experience and employment history

- the types of products the adviser can provide advice on

- if the adviser is a member of a relevant professional body or industry association

- whether the adviser has been the subject of disciplinary action by ASIC

- the name and number of the Australian financial services (AFS) licence holder who employs or authorises the financial adviser to provide advice

- details about who owns or controls the licence holder.

2. Establish their qualifications and experience

3. Find out if they are a member of any associations or professional bodies

4. Ask if they have any “in house products” or if they have a “restricted approved product list”

5. Find out what sorts of people they specialise in advising

6. Ask them to explain how (and how much) it costs to become a client

For all of these steps and more, visit ASICs Smart Money Website on how to choose a financial planner

If you are interested in getting personal, independent advice we would welcome your enquiry.